New Compliance Surveys: “The Answers Are Not Pretty.”

- Richard Bistrong

- May 26, 2015

- 3 min read

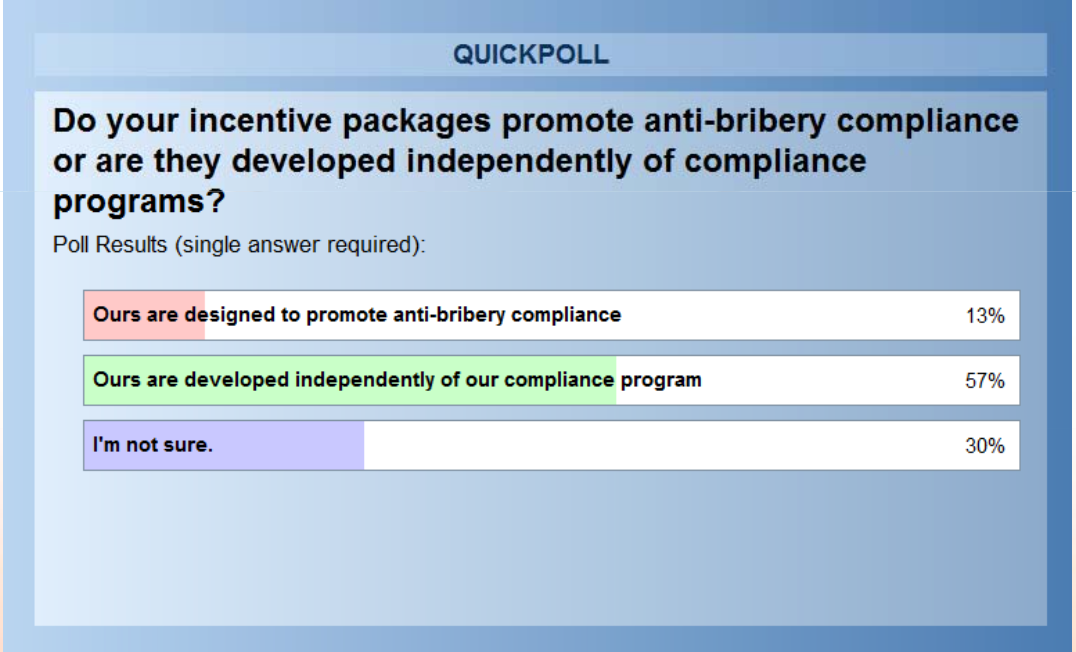

While there is no shortage of compliance and ethics polls/surveys which populate the newsfeeds, there are two that recently caught my attention, both of which point to the same result, as well stated in The Street, The Bull and The Crisis (published by The University of Notre Dame and Labaton Sucharow LLP, link here): “the answers are not pretty.” The other poll, more informal, comes from a recent webinar organized by The Network Inc (link here for the recording and powerpoint), where I was a co-presenter, and where over three hundred participants from the compliance community responded to polls that were presented throughout the webinar. Here is one to start the conversation:

That’s right, 57% of respondents shared that their incentive packages were developed independently of compliance programs. The ramifications of that result are disturbing to say the least, as demonstrating that compliance and compensation remain in organizational silos. What are the consequences of those silos? Well, toggling over to Notre Dame/Labaton work, where over 1,200 professionals were surveyed in the financial services sector, their research found that “nearly one-third of respondents (32%) believe compensation structures or bonus plans in place at their company could incentivize employees to compromise ethics or violate the law.”

It all goes back to the zero-sum crossroad, where front-line personnel ponder the spoken messages of compliance and the unspoken “win above all else” incentive plans. Where those two are developed without coordination and alignment, those at the front-lines of international business will be left to question “what does management really want, compliance or sales success, as I can’t deliver both.” Furthermore, while the Notre Dame/Laboton survey is specific to financial services, readers from other market sectors should not dismiss their research, especially where they share that “23% of those earning $500,000 or more per year report experiencing pressure to compromise (ethics), compared with 9% of those earning less than $50,000.” Again, it returns to the question I often ask: Why are those who are well compensated and educated risking their own liberty (as I did), to engage in corruption, even in what we think of as petty bribery?

Under the “it is worse than we thought” category, the Notre Dame survey finds, “nearly one in five respondents-19%- feel misconduct is part of the recipe for success, nearly double the 11% who remarked as such in 2012.”

Perhaps part of the problem (and hence, the solution) is communication, where compliance personnel need to better understand the corruption risks that front-line teams face in their work. Speaking to this issue, The Network polled webinar participants as to their level of internal communication. Only 12% responded that they “regularly ask front-line international business teams about the corruption risk they face.” Yet another reason why, as the Notre Dame report reveals, “a large number of individuals (are) in the midst of-and losing-an ethical battle of the highest order”

You may ask, what is the connection between communication and losing an ethical battle? It is a multi-dimensional dilemma, but one which presents tremendous opportunities. First, compliance personnel can’t fix or address what they do not know, and as long as field personnel are not part of the compliance communication continuum (did I just invent a new compliance acronym as CCC?), they will continue to make compliance and ethical decisions “on the fly.” As I often share, when it comes to anti-bribery compliance, the distance between where rules, policies and procedures are promulgated could not be further from the “sharp end” of international business, where they must take hold. How to bring those two distant points together can be as simple as bringing overseas teams into the compliance suite and asking “what are the corruption risks you face, the pressures and temptations you confront, and what kind of real-world tools need to be calibrated to help you manage and eliminate that risk.”

As Scott Killingsworth (Partner, Bryan Cave LLP) well states in an Ethikos article (link here), “ethics and compliance professionals cannot hope to be effective in eradicating corruption if we lack a clear understanding, not only of the pressures and temptations involved, but also what actually happens in the head of the salesperson at the crossroads.” As The Network polling demonstrates, in many organizations, the conversation has not even started, which then perpetuates miscommunication, false assumptions and miscalculation, or as Killingsworth better states “irrational calculations.” Furthermore, when compliance personnel start listening and engaging with front-line teams, a sign of good news is when they are upset by what they hear. Why? Because when field teams “true up” and start sharing what is happening on the front-lines, then compliance and business personnel can work together to “fix what they know,” and to un-silo those parts of the organization that perhaps might be delivering mixed messages.

Comments